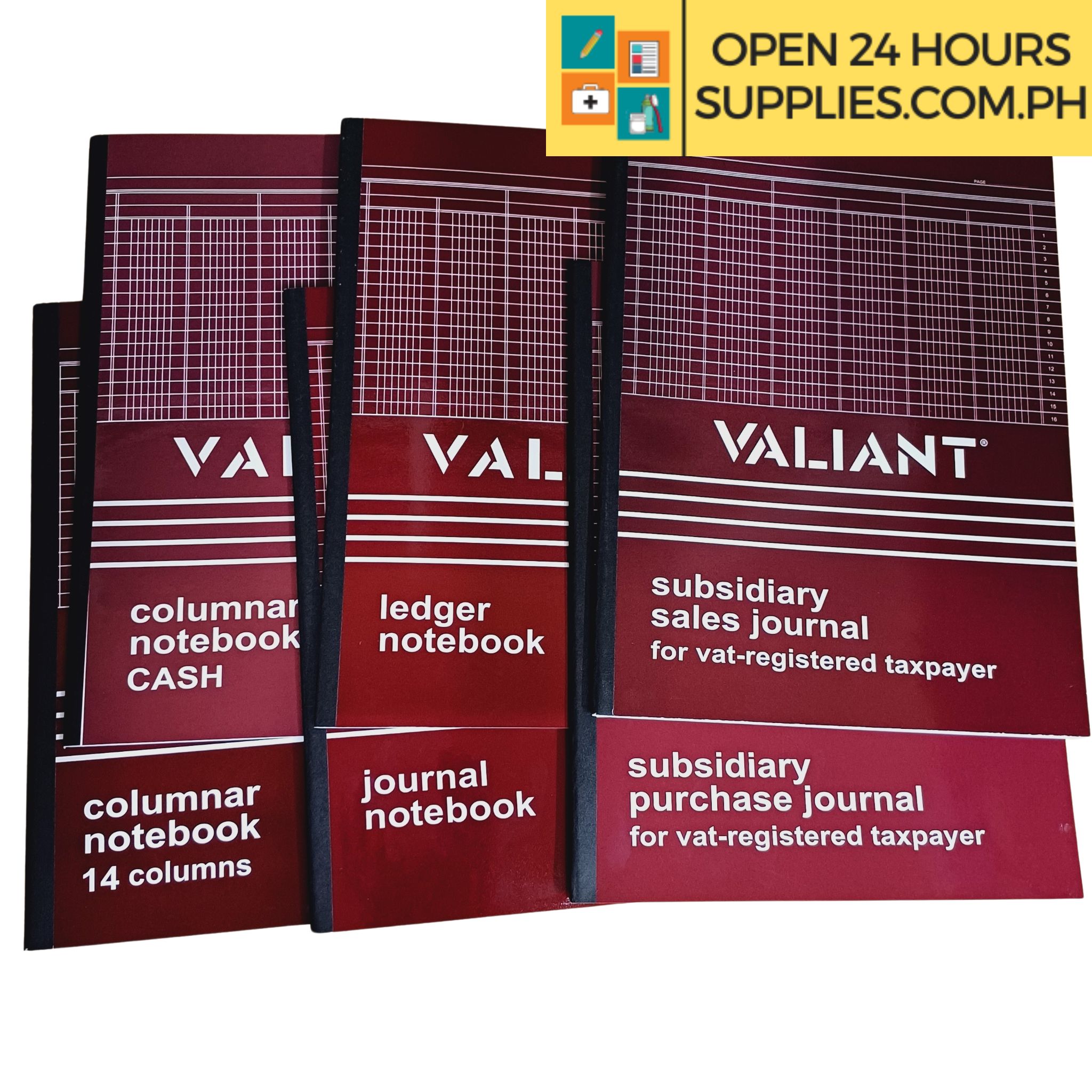

Description

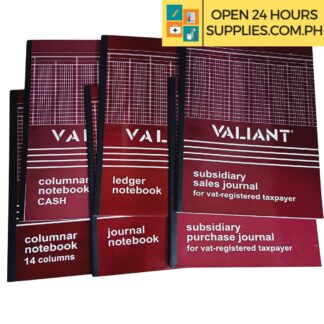

Types of books of Accounts

1. Journal

This is the original entry book. It records the transactions in the order of the date using the debit and credit.

2. Ledger

This is the final entry book. In this book you can see the summarized journal entries of an account to get reconciled balances. This book also tracks your Assets, Liabilities

3. Cash Journal

This book Used to record all cash payments for expenses and/or collections of receivables. Entries can be form of cash sales, Collection of interest Dividends, Rent etc.

4. 14 Columns / Cash Disbursement Journal

This book is Used to record and track the business’s outflow of cash. This will help to keep the General ledger up to date.

5. Sales Journal

This book is a special Journal Used to record sales on credit (Received from customers). Subsidiary Sales Journal is also accepted with BIR

6. Purchase Journal

This special book is used to record credit purchases (Payable to the supplier). Subsidiary Purchase Journal is also accepted with BIR

This Bundle for BIR is designed for both VAT and Non-VAT registered Merchandising and Service Companies. It contains essential accounting supplies to help you keep track of financial transactions with ease.

VAT-Registered Companies: This bundle includes a VAT Sales Book, VAT Purchase Book, and a 12-column Analysis Book to assist in recording sales, purchases, and expenses.

Non-VAT Registered Companies: For companies that are Non-VAT registered, this bundle comes with a 4-column Analysis Book that allows easy tracking of sales and expenses.

All the accounting supplies in this bundle are essential for maintaining accurate financial records as required by the Bureau of Internal Revenue (BIR). Keep your business compliant with the law by using these products regularly.

This Bundle comes with Supplier Warranty so you can be sure that you’re getting reliable products from trusted sources.

Reviews

There are no reviews yet.